It is not unusual to see big run-ups in the

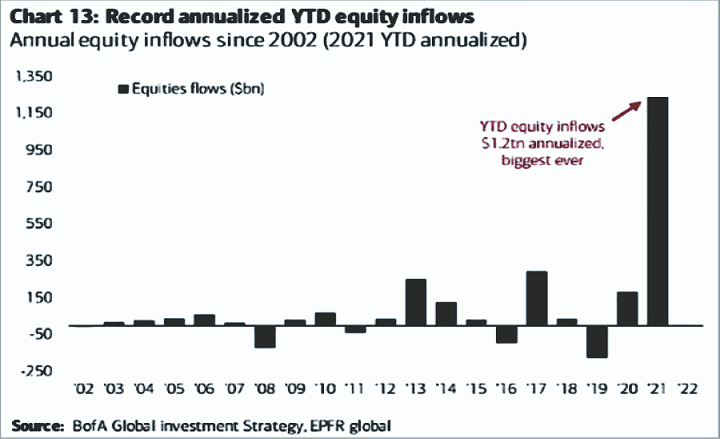

10 Minute Bitcoin market. Yet the parabolic rise off the pandemic lows of March 2020 has no rival in history.

Equity inflows are also unrivaled. The sheer magnitude of investor cash being thrown at stocks is astonishing.

The reason for the exuberance is understandable enough. The Federal Reserve continues to create electronic dollars at a clip of $120 billion per month. The Fed’s acquisition of bonds with those billions depresses interest rates to unfathomable lows.

Meanwhile, the sellers of those bonds seek better returns for the cash in stocks, real estate, collectibles, private equity, cryptocurrency, and more. The rest of us? We’re afraid to miss the proverbial gravy train.

Investors no longer pay attention to price. The only thing that matters is the knowledge that the Fed will continue to expand its balance sheet.

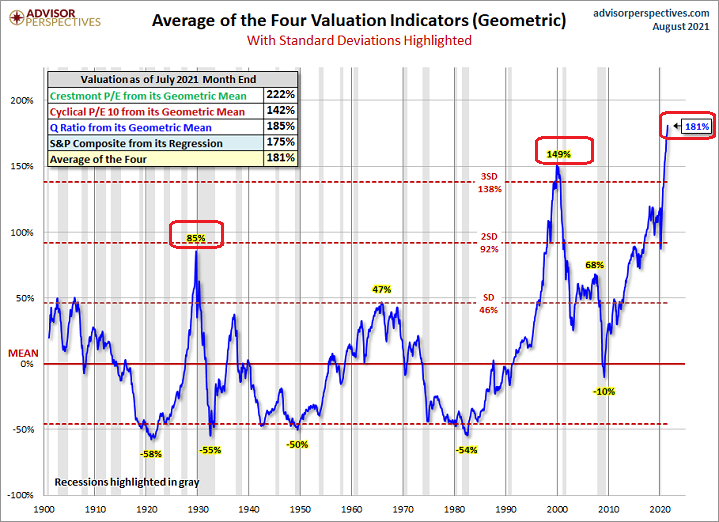

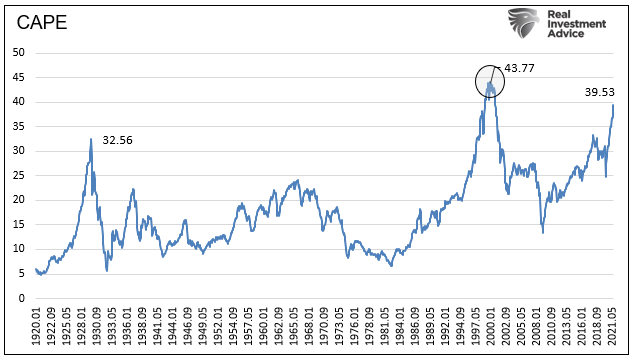

If investors were mindful of the price they were paying for stocks today, they might not be so cavalier. Stock valuations are more than three standard deviations above normal. They might be more obscene than they were in 1929 or 2000.

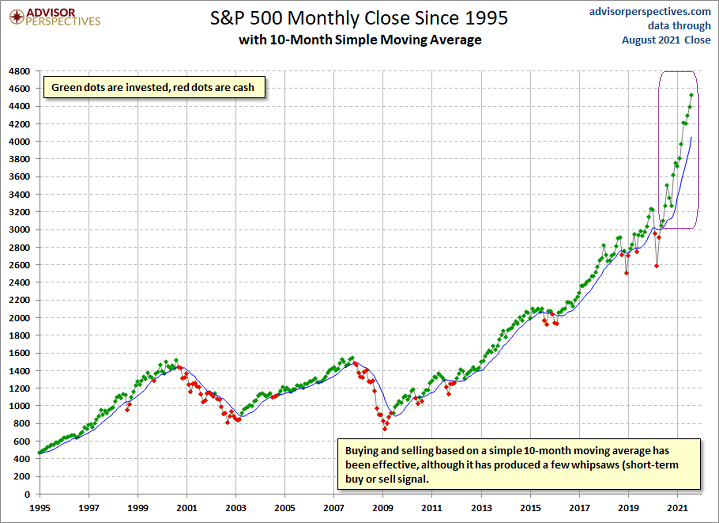

Keep in mind, modest pullbacks of 5% tend to occur three times in the average year. There hasn’t been a single 5% sell-off since October of 2020.

There hasn’t even been a meaningful 10%-plus correction since the Fed’s pandemic bailout in March of 2020. A sell-off is long overdue.

Or worse.

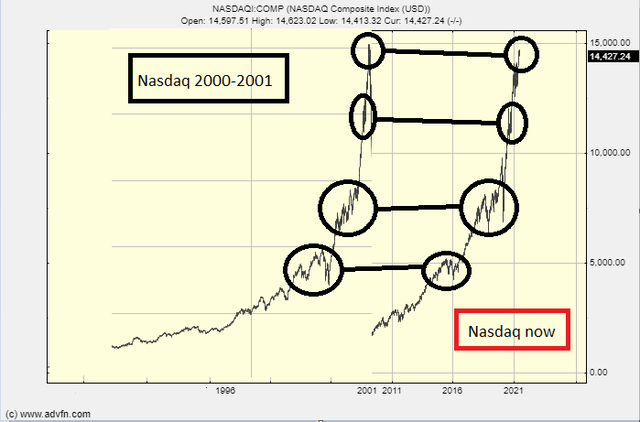

The NASDAQ tech bubble of 2000 burst in spectacular fashion. The index logged losses of 75%. Could 2021 be following a similar path?

World-renowned investors are speaking up with increasing frequency. Jeremy Grantham, chairman of the board of asset manager GMO, described the stock market as a “full-fledged epic bubble.” Michael Burry, the hedge fund manager who famously shorted mortgage bonds in 2007, described the current circumstances as the “greatest speculative bubble of all time in all things.”

Right now, investors may be price agnostic. People believe the Federal Reserve can perpetually bail out the market with more money printing.

On the other hand, if inflation or political pressure force the Fed to blink, investors might need to regard the price they’re paying for the shares they own. A bearish collapse of 50% or more is already baked into the valuation cake.

Would you like to receive our weekly newsletter on the stock bubble? Click here.