Corporate insiders are selling shares in monstrous amounts. The unusual level of activity suggests that executives are wary of overvalued stock pricing.

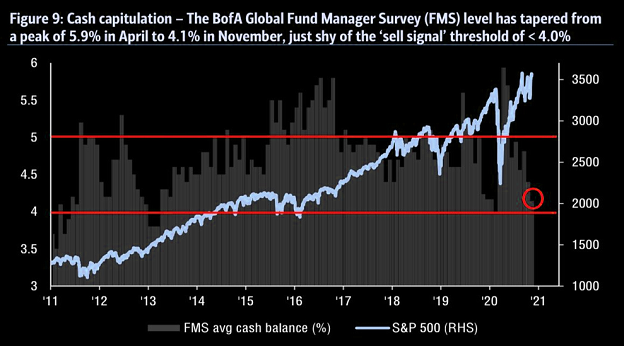

In contrast, retail investors and fund managers alike are exceptionally bullish on stocks. For instance, fund manager cash levels have dropped to percentages last seen the month before the pandemic hit.

Sentiment traders view unusually low cash percentages as well as uncommonly high insider selling with caution. Should you?

Perhaps.

Citigroup’s Panic-Euphoria indicator — a measure that incorporates everything from options trading to margin debt to bull-bear sentiment — has reached its highest level since the month prior to the pandemic panic. How troublesome is that? Tobias Levkovich, Citigroup’s chief equity strategist, explained that the “…euphoric readings signal a 100% probability of losing money in the coming 12 months.”

Would you like to receive our weekly newsletter on the stock bubble? Click here.