In the last three weeks alone, nearly 17 million made it to the jobless claims tally. There are likely another eight million coming over the next two weeks. Net result? Unemployment is likely to hit 20%.

Think about the adverse impact on consumption. People will need to spend less money. Even those who remain employed are going to curtail spending, even when virus restrictions abate.

One cannot witness these sorts of economic shifts and realistically anticipate that they will magically fix themselves when the nation flattens the virus curve. Not only do unemployment and underemployment affect consumption, but even the post-virus willingness to congregate in restaurants, bars, sporting venues, beaches, hotels, theaters may be lessened.

There’s more.

There are scores of disruptions in global supply chains. A vaccine will not be available immediately. And corporations have precious little visibility on the future of their revenue and profits.

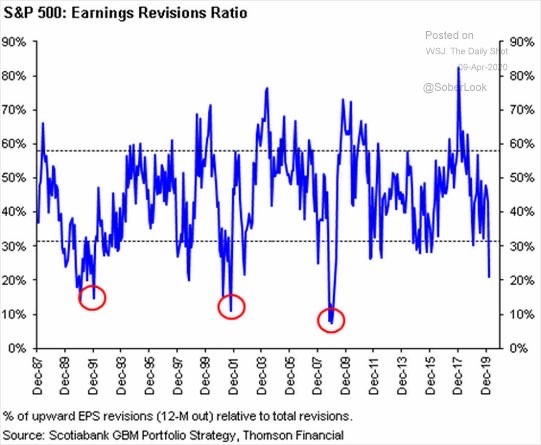

Needless to say, Wall Street analysts are behind on downward revisions to earnings per share (EPS). With the current economic crisis being far worse than the early 1990s, early 2000s or 2008’s Great Recession, the S&P 500 Earnings Revisions Ratio has yet to reflect the severity of the economic contraction.

Please click here if you’d like to receive our weekly newsletter.