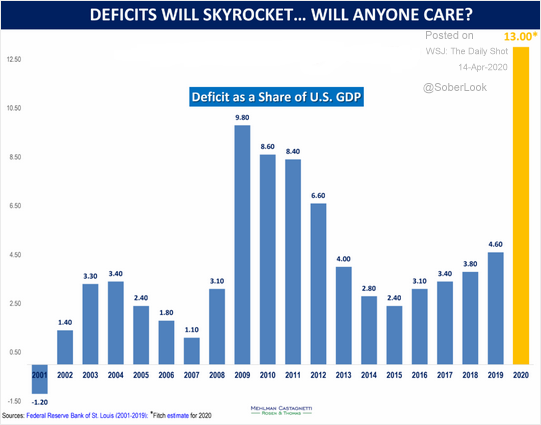

We already know that the economic deterioration will be far more severe than the Great Recession. That’s why the federal government has served up freakish amounts of stimulus.

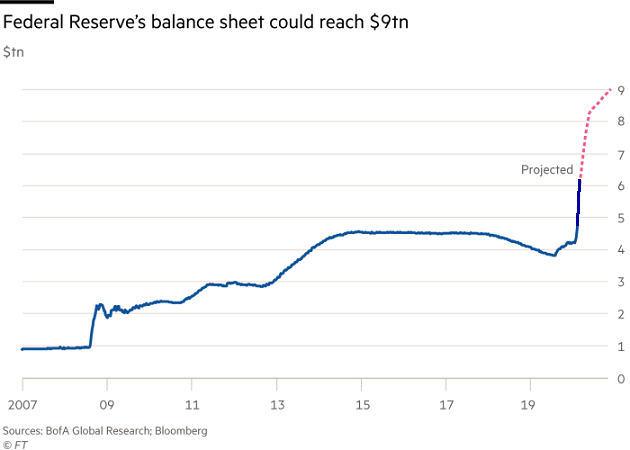

In a similar vein, the Federal Reserve intends to do whatever it takes to stimulate stock and bond investment. The growth of its balance sheet has gone vertical. Literally.

The speed and the aggressiveness of the stimulus efforts propelled the S&P 500 SPDR Trust (SPY) to retrace more than 50% of its bear market losses. The same pundits who failed to “call” any bearish price depreciation at the onset, and who later went on to “call” a much deeper bear market bottom, now express confidence that the index will never retest its 2237 low from March 23.

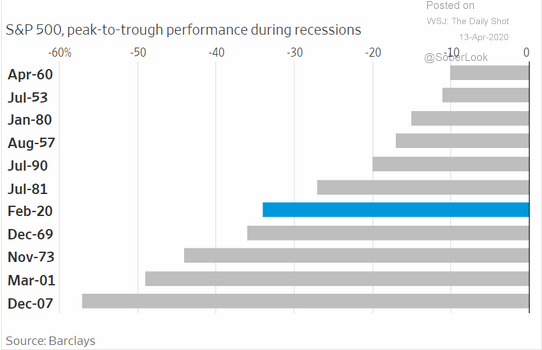

Will predictions mislead folks yet again? With stocks down only 18% from their February 19 all-time highs — with the stock selloff only reaching levels commensurate with milder recessions (34% peak-to-trough) — the notion that markets have already found their footing may be fanciful.

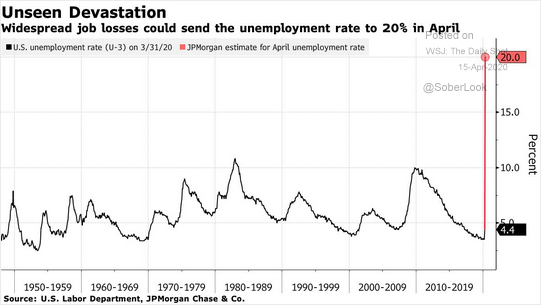

Let’s start with the obvious: 20% unemployment is a long way from ideal. Before it is all said and done, unemployment may reach 25%. Has Mr. Market genuinely priced in the harshness of these economic surprises?

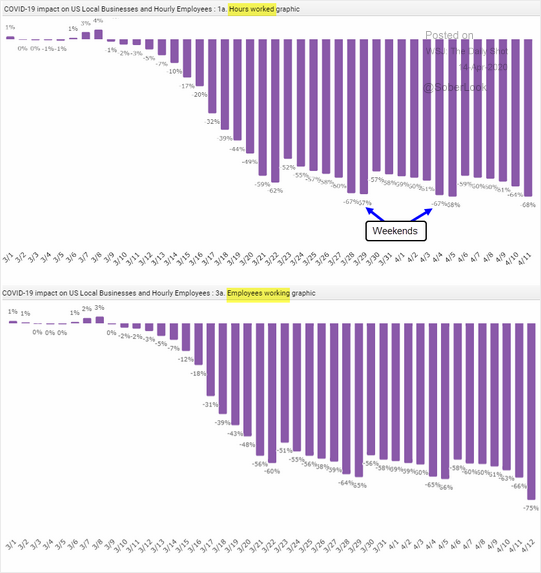

In particular, unemployment data does not accurately depict the loss of income that is occurring. Do you have friends or family members who have been furloughed? I do. Do you know employed people who are getting less in the way of commissions right now, and who will be getting less in the way of bonuses by year-end? I do. Do you know anyone who has been “asked” to take a salary reduction? I do.

In other words, there are plenty of employed people who will not have as much discretionary income as they had before. You can even see the significant reduction in income for hourly employees via the reduction in the number of hours worked.

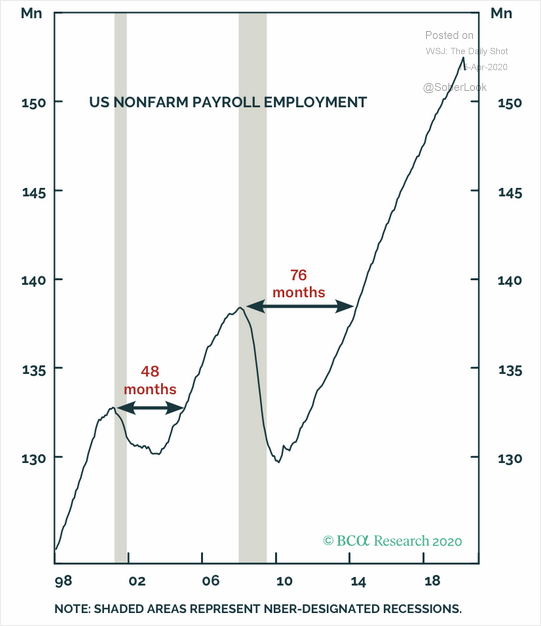

V-shaped recovery optimists believe that jobs will come back in a flash. That idea is not consistent with recent recessions. It took four years to get back the jobs lost from the tech bubble’s bursting at the start of the century. It took more than six years to get back the jobs lost due to 2008’s financial crisis.

Granted, stimulus via the Paycheck Protection Program (PPP), $1200 coronavirus checks and unemployment compensation increases mitigate the severity of income loss. Nevertheless, in aggregate, most will not be made whole.

“But the stock market’s not the economy,” you say. That’s true. However, sharp income losses translate into less consumption of services and goods. Placed in the context of corporate America, public companies will experience dramatically lower revenue and profits.

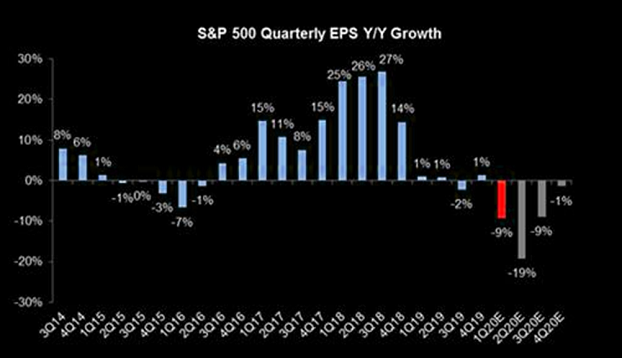

By way of review, year-over-year earnings per share (EPS) peaked in the 3rd quarter of 2018. That was the top of the cycle. Companies were already flailing aimlessly going into the COVID-19 calamity.

In truth, the only thing expanding in 2019 were multiples/valuations. Stocks were wildly overvalued going into 2020 as they stared down the virus-related abyss.

Can stimulus alone really keep stocks at levels that are every bit as elevated as they were in January due to the downturn in sales, earnings and free cash flow? Sadly, the titanic drop-off in household consumption only tells a portion of the story.

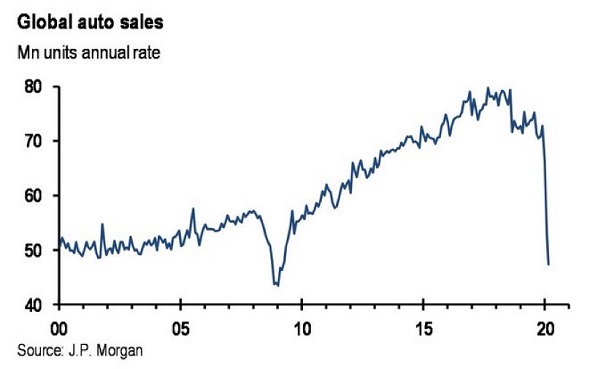

For example, nobody is buying a car, SUV or truck. Nobody. (See the chart below.) A V-shaped recovery advocate would suggest that auto sales would come flying back once the U.S economy opens back up.

In contrast, a realist would note that nearly one-third of home mortgages are in forbearance. If they are struggling to meet current mortgage requirements, the chances are strong that they’re struggling to meet their auto loan issues as well. It is more likely than not that millions will default on current auto loans as opposed to qualify for and acquire a shinier automobile.

Meanwhile, the loss of income that drives consumption will not be confined to the household level. Businesses lose income when there are shocks to supply or demand or both.

We already know how Chinese factory shutdowns adversely affected supply chains. Even now, some farmers cannot get produce/meats to consumers because of COVID-19 quarantines and lock-ins. It may take time for corporations to reconfigure suppliers and supply chains before they’d be able to sell their goods.

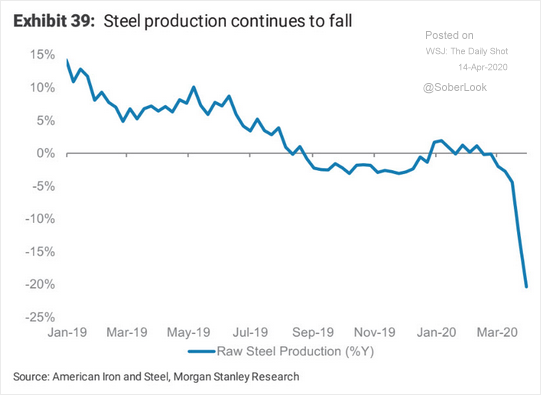

The demand side for corporations is equally daunting. Just about every commodity involved in “making stuff” has fallen off the bunk bed.

If stimulus programs were enough, from the unprofitable oil patch to the decimated airlines, from the automakers to the tourism-dependent hotels, from the brick-n-mortar retailers to the chemical makers, perhaps there’d be less reason to be cautious. On the other hand, not all debts at these companies will be completely forgotten about, even with the Federal Reserve buying iShares iBoxx $ High Yield Corporate Bond ETF (HYG).

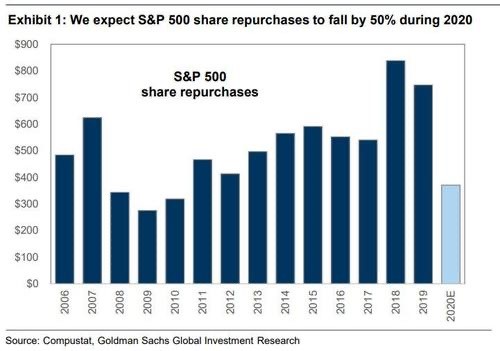

Put another way, debt repayment and/or restructuring saps cash flow. Many may opt for bankruptcy. And for those who are able to muddle through? Limited cash for dividends and zero cash for share buybacks.

The buyback conundrum is a huge downer for equities. It is one thing to recognize that lower profitability is likely to hurt the perceived value as well as the intrinsic value of stocks. It is another thing to see that a “business income recession” kills the buyback golden goose.

Okay. So you think that none of this matters. Best Buy furloughs 50,000 employees and JC Penney explores bankruptcy. So what. It just means that Amazon (AMZN) is taking over, as its share prices continue to notch all-time records.

Well, then. If it is this simple, go longer on Amazon than you already are via the Nasdaq 100 ETF (QQQ), and short brick-n-mortar retail via ProShares Decline of the Retail Store ETF (EMTY). It’s not like I haven’t played with that trade in personal accounts.

From a longer-term investment thesis, however, one needs to be prepared for the retracement rally to meet economic gravity. A V-shaped recovery is not in the cards. More critically, the current nature of the aggregate stimulus will not be enough to levitate the stock market back to its prior record peak.

Specifically, this bear is not likely to end until the Fed fires off the ultimate bazooka. They’ll need to buy stock ETFs.

Keep in mind, I am not in favor of the Fed buying corporate bonds with the help of the Treasury. I will not be pleased when the Fed buys stock ETFs with yet another taxpayer-funded “Special Purpose Vehicle.” Yet the Fed will do so if stocks head toward the lows of March 23. They might not even wait that long.

Investors who were smart enough to put aside “dry powder” for an eventual recession, who were savvy enough to nibble near the March 23 lows, will get yet another opportunity. Wait for it. Develop your wish list, and wait for it.

For some client accounts, with the S&P 500 down more than 30%, we picked up a bit of Cisco (CSCO), Home Depot (HD), Anheuser Busch InBev (BUD), Pepsico (PEP), Crown Castle (CCI) and/or Fortinet (FTNT). We already had a fair amount of Johnson & Johnson (JNJ).

Still, our overall allocation is significantly lower than it would be in a strong bull market uptrend. We are extremely unlikely to return to our full equity targets (e.g., 60% for balanced, 65%-70% stock for moderate growth/income, 70%-75% for moderately aggressive growth, etc.) until the Fed fires off the ultimate bazooka and announces its intention to buy stock ETFs.

Would you like to receive our weekly newsletter on the stock bubble? Click here.