The financial media would like you to believe that COVID-19 is the sole reason for economic hardship and financial market losses. Unfortunately, few outlets have been willing to dig deeper beneath the surface.

For instance, before corona was a “thing,” consumer durables had declined 7.4% on a year-over basis. People had already been scaling back in a very big way on electronics, home furnishings, appliances, jewelry and exercise equipment.

It gets worse.

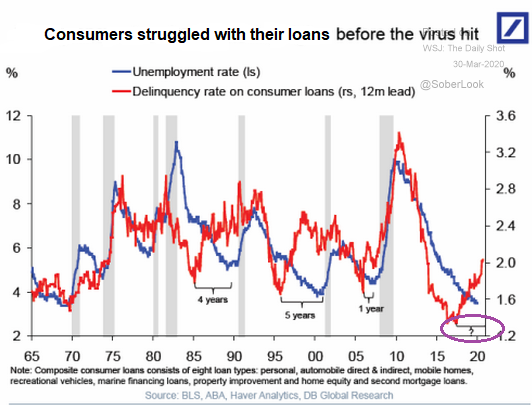

Consider the sharp rise in delinquency rates for consumer loans. Sometimes the indicator takes many years before recessionary pressures strike.

Nevertheless, consumers at “full employment” were having difficulty paying back all kinds of loans — credit cards, auto, student, personal and mortgage. Post-virus? Post job layoffs? Stimulus dollars are far more likely to go toward paying down some debt than into eating at restaurants or acquiring “stuff.”

Please click here if you’d like to receive our weekly newsletter.