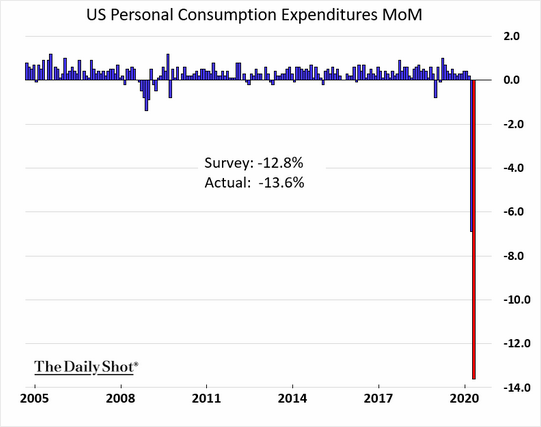

Americans will surely spend some money when the economy “opens back up.” Yet, how much will they consume?

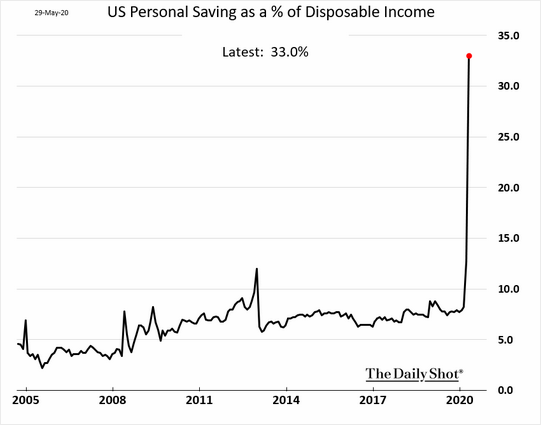

As it stands, households are dramatically increasing their savings. And according to a number of surveys, approximately 40% of savers are doing so because they do not have enough money for discretionary items.

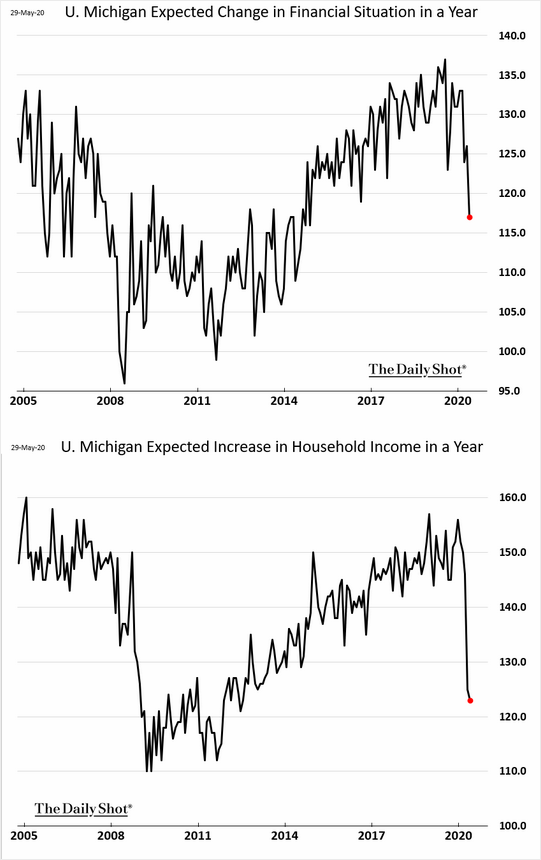

In a deeper dive, we see that fewer households believe that their overall financial situations will be better one year from now. Perhaps families worry about paying loans as well as utilities. Others may fear that the value of their retirement savings and/or residences will be lower.

Similarly, households anticipate that their incomes will be lower in May of 2021. It follows that, should this turn out to be true, people will find it exceedingly difficult to spend the way they had been spending back in 2019.

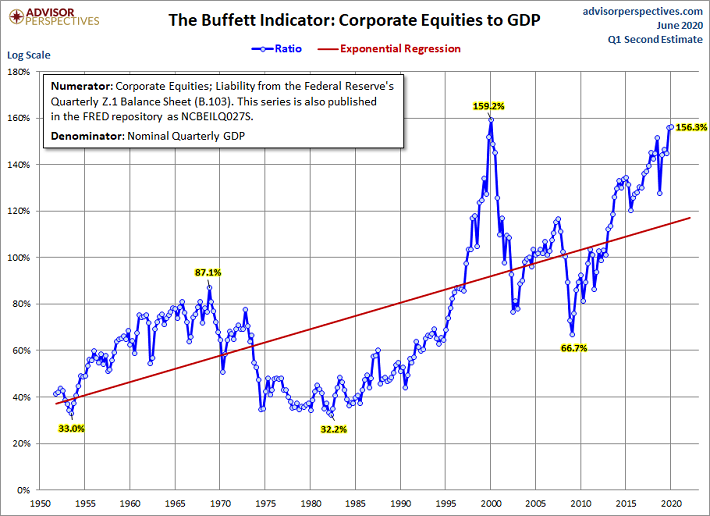

Which begs the question… If consumers will be buying fewer products and services from public corporations one year from now, how long will it take for the 2020 stock bubble to recognize the adverse impact on corporate well-being?

Would you like to receive our weekly newsletter on the stock bubble? Click here.