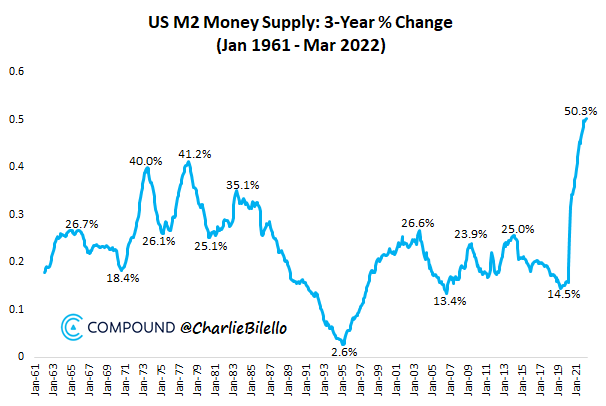

Why was inflation so horrendous in the 1970s? The U.S. Money Supply increased by more than 40% in a 3-year period.

Why is inflation so troublesome today? The U.S. Money Supply increased by more than 50% over the last three years.

Apologists say that the money printing was necessary to get people through the 2020-2021 pandemic. And, at first blush, it may have been difficult to dislike skyrocketing asset prices.

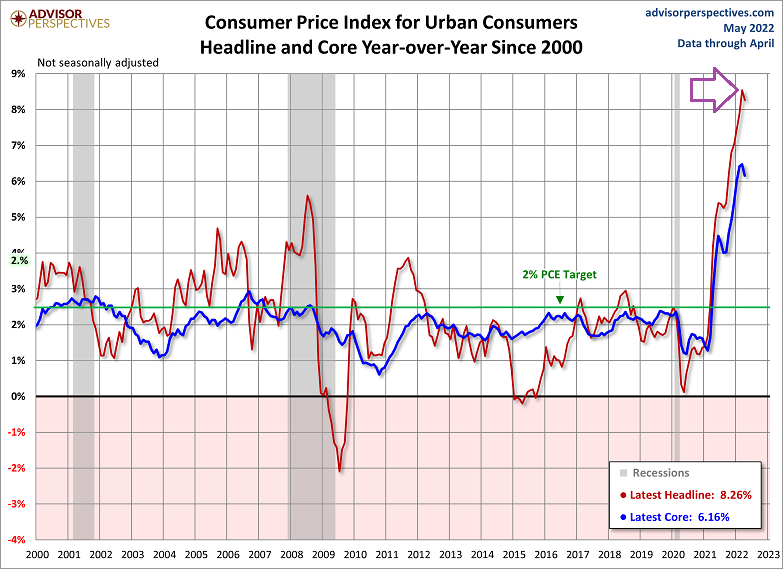

Unfortunately, money printing does more than electrify assets (e.g. stocks, bonds, real estate, crypto, collectibles, etc.). It sends the cost of living through the roof.

To tackle inflation here in 2022, the folks running the Federal Reserve system have been busy reversing direction. Specifically, the Fed has been manipulating borrowing costs higher and pledging to reduce the amount of electronic money it created.

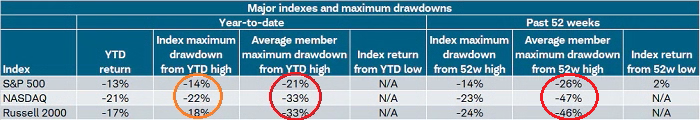

A significant consequence? This is the first time that investors have ever seen stocks and bonds simultaneously enter drawdowns of double-digit percentages. The S&P 500 has pulled back approximately 16% while aggregate bond indices have coughed up 11%-12%.

That’s not the worst of it.

At the index level, stocks may not have hit -20% losses that define a stock bear. However, when one examines the average individual stock within a respective index – S&P 500, Nasdaq, Russell 2000 – 21%-47% losses have already occurred.

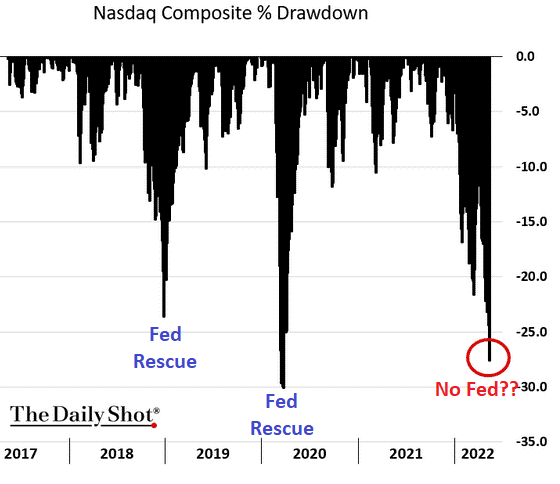

In the recent past, investors could count on the Fed to “bail them out” when drawdowns approached 20% on the S&P 500 and 25%-30% on the Nasdaq. In 2018, Fed Chair Powell shifted from tightening activity to stimulus overnight. In 2020, the Fed went from stimulus to insanity, as it endorsed trillions in electronic money creation alongside zero percent rate policy.

Investors like to call it the “Fed Put.” That’s when the Fed steps in to implement actions to stop stock market declines in their tracks.

Right now, however, the “Fed Put” does not exist near S&P 500 drawdowns approaching 20% or Nasdaq sell-offs approaching 25%-30%. And with the Fed is still talking tough on the inflation front, nobody knows exactly where the Fed would step in to save markets.

There’s more.

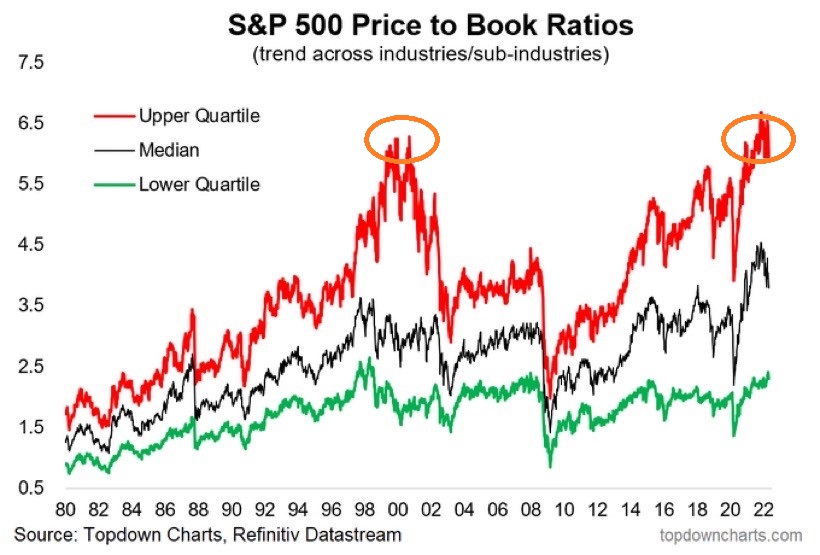

Even after the volatile drawdowns of 2022, stocks are not particularly cheap. On a price-to-book basis, stocks still appear overvalued in a similar way to the stock bubble of 2000. (Could it be that we are just getting started?)

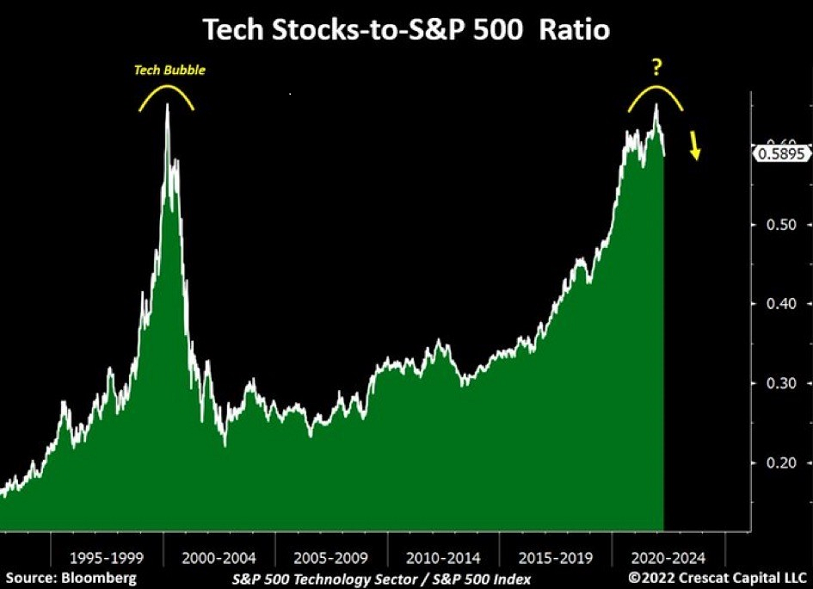

The 2022 stock balloon may indeed resemble the 2000 tech bubble. A simple comparison of the ratio between the tech sector and the broader S&P 500 provides a glimpse into the familiar frothiness.

Would you like to receive our weekly newsletter on the stock bubble? Click here.