Those with significant money at stake in 2000 remember what happened to them in 2000. They lost the bulk of their money.

Investors certainly heard the warnings in the late 1990s, but they did not listen. Words of caution fell like silent raindrops.

It was a “New Economy.” Companies did not need to show profits. They needed to embrace the dot-com handle and get listed on an exchange.

Non-profitable businesses offered shares on the NASDAQ. Prices skyrocketed instantly. And participants with cryptocurrency-like zealotry got rich. (For a while, anyway.)

Dot-com stocks began to crash in March of 2000. Shortly thereafter, profitable tech corporations followed suit. And eventually, the rest of the stock market tanked.

A similar phenomenon may be in the works today. Non-profitable tech quadrupled (400%) during the pandemic. However, it has been on a bearish track since early in 2021.

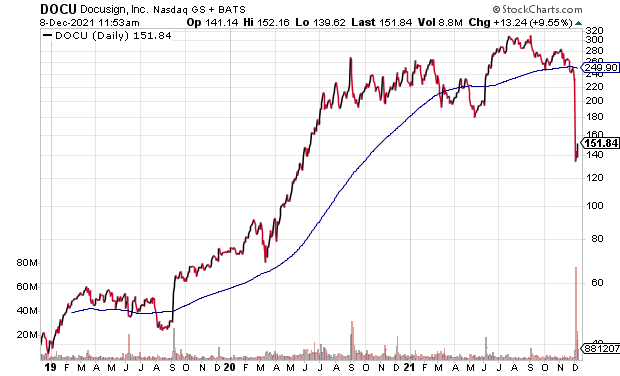

The selling has been contained to speculative names so far. Yet, established tech superstars are also starting to falter. (Think DocuSign.)

Post-pandemic investors are, for the most part, dismissing what is written on the subway walls. They’re quite comfortable with the notion that the Federal Reserve has the ability to prevent any long-lasting damage to stock prices.

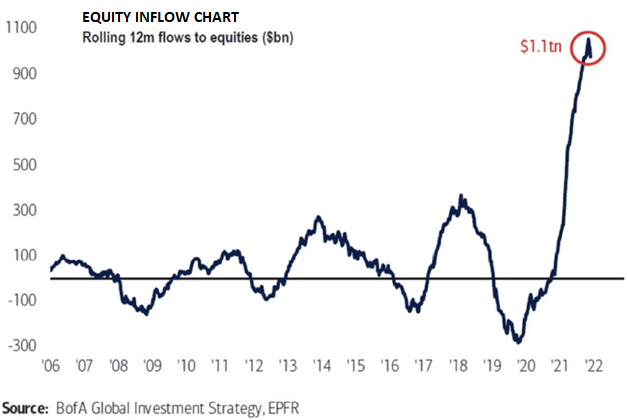

How confident is the 2021 participant? Inflows into stock assets on a rolling 12-month basis is greater than the combined inflow of the prior 19 years… combined!

Perhaps unfortunately, the Powell-led Fed is dealing with an inflationary backdrop. One that is not so transitory after all.

How does a country’s central bank battle the erosion of a currency’s purchasing power? Terminating, not enacting, digital dollar creation. And at some point, raising overnight lending rates.

It follows that the central bank of the United States may not be as quick to digitally print trillions of dollars the next time that stocks fall 10%-20%. Indeed, if the Fed does not come to the financial market rescue, as it has on every 10%-20% pullback for 12-plus years, the stock bubble could see a genuine reckoning.

Consider just how insanely overvalued the stock market is here in December of 2021. The total market capitalization of U.S. stocks is nearly $69 trillion. That is 3x the level of our gross domestic product ($23 trillion). At the height of the 2000 stock bubble, total market capitalization only reached 1.9x gross domestic product (GDP).

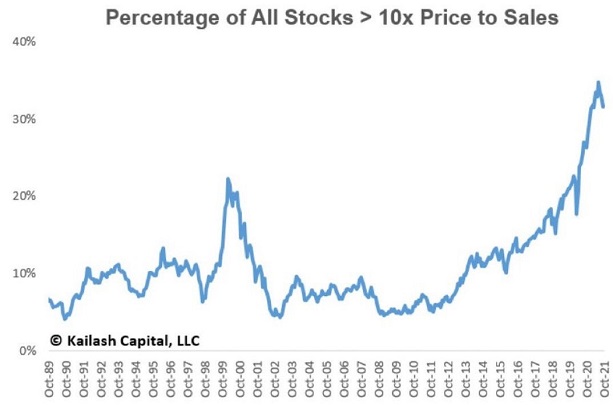

Here is another way of looking at it. At the 2000 bubble peak, the percentage of all stocks that hit asinine valuation levels of 10x revenue was roughly 23%. In 2021? Close to 35%.

Granted, it may be impossible to gauge how the Fed would react to a stock market that reaches a bearish decline of 20% if inflation is still running hot. Most are investing as though the Fed would undoubtedly give the stock market more stimulus rather than fight inflation.

On the flip side, inflation is killing the livelihood of everyday Americans. Those without solid portfolios of stock, real estate, bonds, crypto and collectibles. This fact may make it more difficult for the Fed to backstop stocks at the risk of letting inflation get out of control.

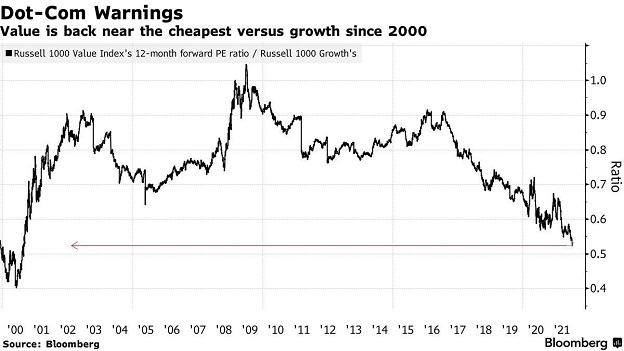

If nothing else, it may make sense for investors to lean into value-oriented stocks. Those with favorable fundamentals. Those that have been largely overlooked for many years.

Would you like to receive our weekly newsletter on the stock bubble? Click here.