Are we already in a recession? It’s certainly possible.

The economic world typically defines a recession as having two consecutive quarters of negative growth. The measure of that growth? Gross domestic product (GDP).

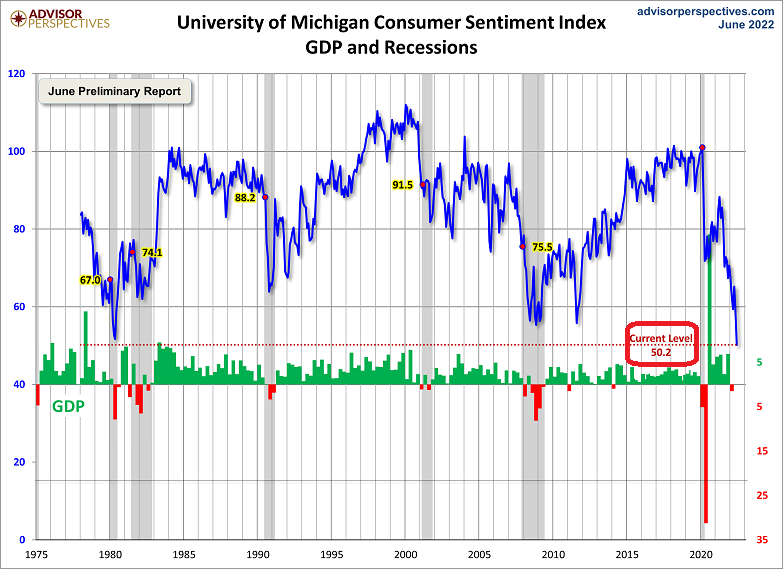

GDP contracted in Q1. And according to the Atlanta Fed’s projections, GDP is only expected to grow a meager 0.9% in Q2.

The way things are going in June so far — quantitative tightening by the Federal Reserve (QT), abysmal consumer sentiment, skyrocketing inflation — the modest Q2 growth may not occur. We may even see shrinkage in the second quarter. And if that happens… a recession would become “official.”

How can a recession occur when employment has been so robust? Blame inflation. Not only has it sent consumer sentiment to its worst reading in the history of the data series, but levels this low have always occurred in association with recessions.

Nor does it help that homebuyer sentiment is also at record lows.

So what’s the impact on the stock bubble?

The Nasdaq, Russell 2000 and Wilshire 5000 have already closed in bear market territory. Meanwhile, the broader market’s S&P 500 is still attempting to avoid the inevitable.

Would you like to receive our weekly newsletter on the stock bubble? Click here.