Despite a worldwide pandemic, astronomical stock valuations, the deepest recession since the Great Depression and a contentious U.S. election in November, the S&P 500 has rallied back to within 0.25% of a record high. As I type, in fact, the S&P 500 could finish at a fabulous new peak (8/13/20).

It is simple enough to explain. Mark Cuban explained it. (Click here.) And more recently, George Soros elaborated on the craziness.

The multi-billionaire who recently turned 90 acknowledged that the U.S. is caught up in a stock bubble powered by Federal Reserve liquidity. Soros is avoiding the financial markets altogether.

Okay. So, Fed liquidity got us here. But how can money printing madness continue to sustain stock bubble insanity?

According to Soros, Wall Street is confident in a second round of fiscal stimulus. Moreover, he anticipates political gamesmanship on the presentation of a vaccine solution prior to the November election.

Granted, fiscal stimulus, Fed liquidity as well as Fed programs designed to bail out over-indebted public corporations have been propping up the shares of public companies. Yet, the U.S. economy’s well-being is far more dependent on private American businesses, particularly the smallest ones. And they’re hanging on by a thread.

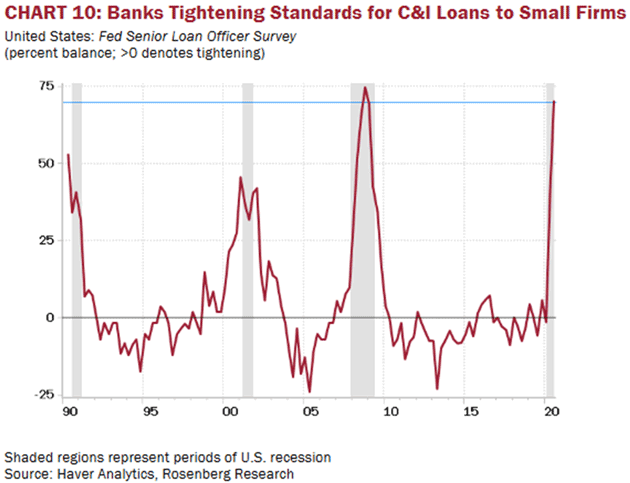

Consider the credit cycle for private companies. With banks still tightening their lending standards, how will these businesses survive?

What does the data imply? Small, private businesses — the collective engine of economic growth — cannot procure credit. If small businesses are cut off from borrowing, the economy cannot grow. And if the economy cannot grow in earnest, the stock bubble may take notice and begin to deflate.

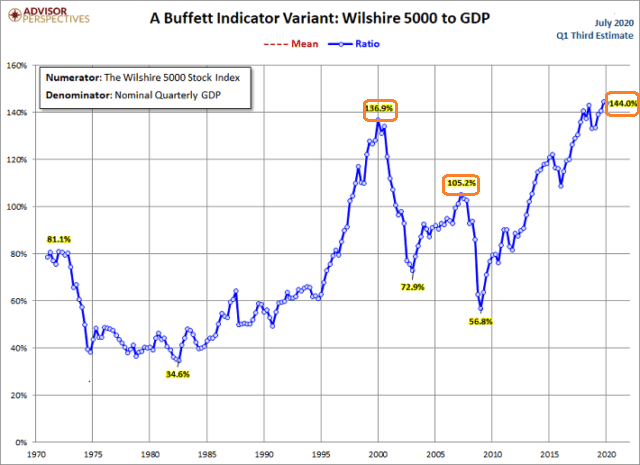

As things already stand, stocks may be more expensive than at any other point in history. At least on the Warren Buffett indicator, market-cap-to-GDP.

Remember, Warren Buffett once described market-cap-to-GDP as “…probably the best single measure of where valuations stand at any given moment.” The Wilshire 5000 total stock market capitalization relative to gross domestic product (GDP) is HIGHER today than it was during 2000’s tech bubble.

Would you like to receive our weekly newsletter on the stock bubble? Click here.