Large-scale bankruptcies have been slamming the U.S. economy. Worse yet, the expectation is that many companies, particularly in energy, retail, and tourism, will not be able to outrun the slow-growing economy going forward.

How can one tell that the economy is still reeling from the pandemic? And that the notion of a swift recovery is whimsical at best?

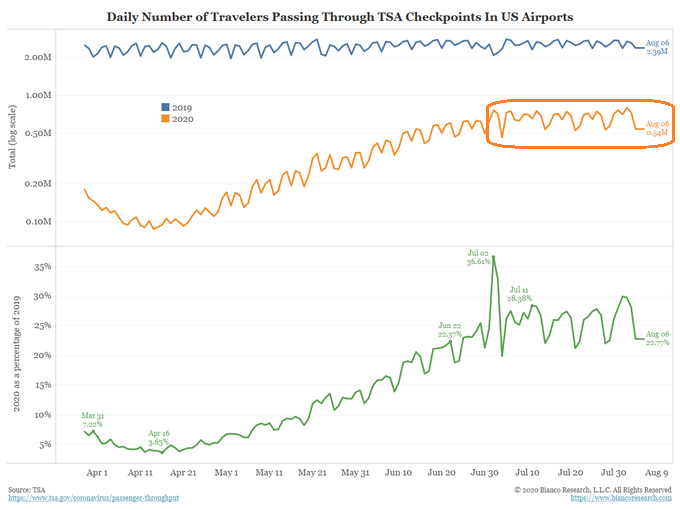

Consider air travel. People passing through TSA checkpoints are running at one quarter of the pre-pandemic numbers. Disturbingly, it is decimating industries like restaurant, leisure and entertainment.

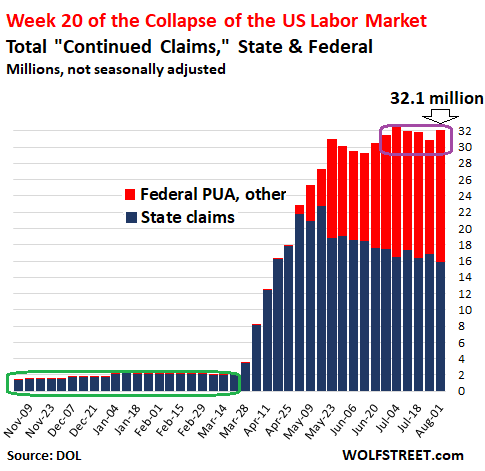

Similarly, there are 32 million people collecting unemployment benefits. That is 20% of a diminished labor force. And despite what many in the financial media would like you to believe, the data are not improving.

Stock prices, in complete contrast, keep rising and rising. The S&P 500 is a mere 2% from all-time highs set in mid-February.

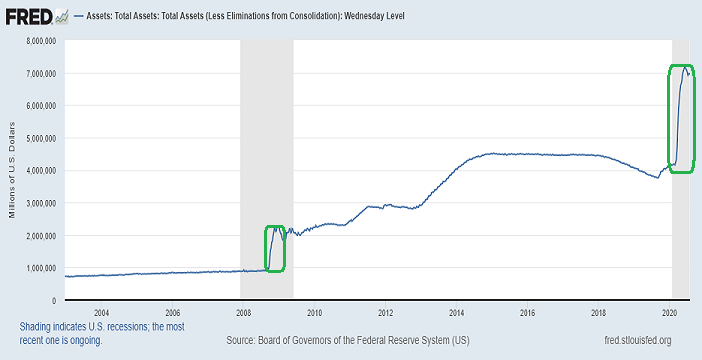

Some would have you believe that this is a reflection of wonderful things happening in the very near future. Honest market watchers know better; that is, it’s all about Federal Reserve money printing and asset purchasing (a.k.a. “liquidity”).

Notice that the easy money Fed came late to the stock market reflation party in 2008’s financial collpase. Here in 2020, however, the Fed acted at the onset of the “virus” recession, rather than two-thirds of the way through.

Timing of Federal Reserve stimulus has meant everything. (Not to ignore trillions of additional dollars this go-around.) It has meant the difference between a 57% stock collapse that required four-and-a-half years to come back from and a 33% crash that required four weeks to make up for.

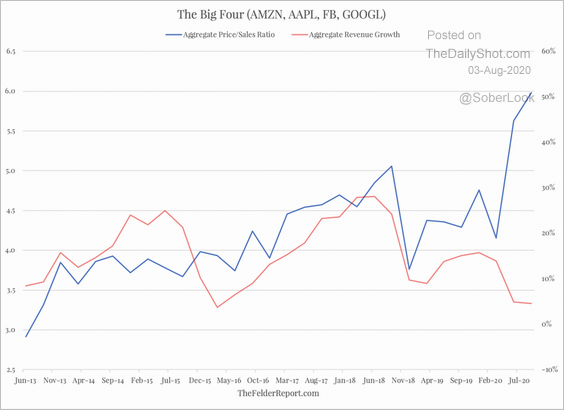

What few are appreciating is just how skewed the market is towards the success of mega-cap corporations like Facebook, Amazon, Apple and Google.

Granted, these companies did not see massive revenue or earnings declines in the current economic disaster. Yet, as their prices rise into the stratosphere, so have their valuations. The aggregate price-to-sales data demonstrate bubble pricing for exposure to the “Big Four.”

Traders may be taking notice. The CBOE Skew Index shows that the relative demand for low strike puts has increased dramatically.

Sometimes, huge corrections come about when the CBOE Skew Index is spiking. It is certainly worth watching at a time when the disconnect between economic hardship and stock market prosperity is reaching epic proportions.

Would you like to receive our weekly newsletter on the stock bubble? Click here.