Christian Bale played hedge fund manager Michael Burry in The Big Short. The actor’s portrayal of an eccentric loner with genius-like qualities was downright riveting.

Of course, it was Burry, not Bale, who anticipated the implosion of the housing balloon. It was Burry, not Bale, who earned hundreds of millions of dollars by betting against subprime securities.

Here in 2021, very few folks seem to remember 2008’s real estate wreck and concomitant credit crisis. Even fewer remember Michael Burry.

Interestingly enough, Mr. Burry uses his Twitter account. Here is what he posted yesterday (6/15/2021):

“People always ask me what is going on in the markets. It is simple. Greatest Speculative Bubble of All Time in All Things. By two orders of magnitude.”

Is Mr. Burry exaggerating? Is he simply stirring the proverbial pot? Maybe not.

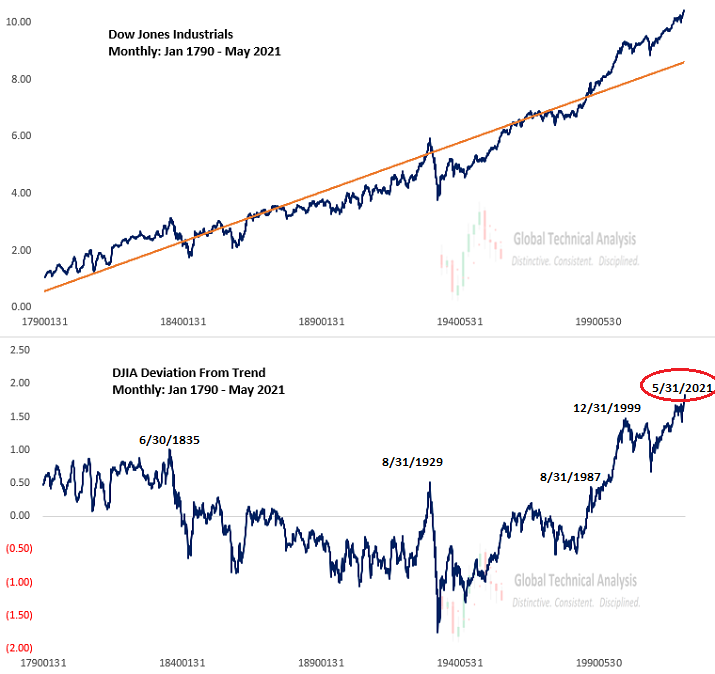

Consider technical analysis dating back to 1790. The month-ending closing price for the Dow Jones Industrials Average has never deviated this far above a trendline. Not at the peak of 1929’s infamous crash. Not at the height of the turn-of-the-century stock bubble.

Maybe you do not value technical analysis. Fair enough.

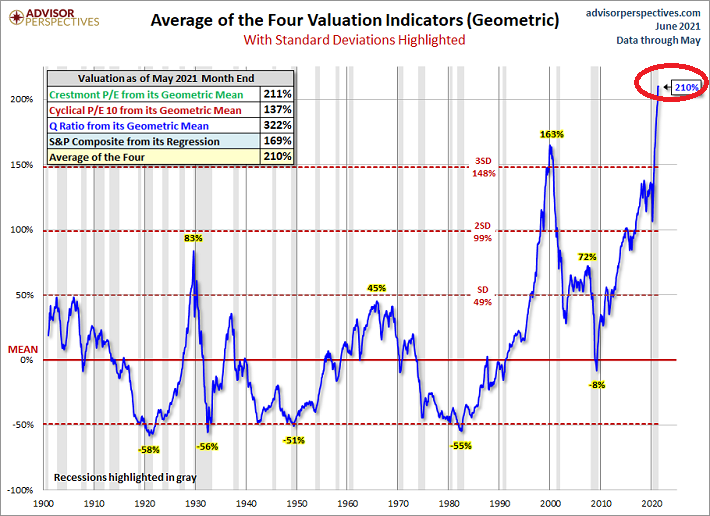

Unfortunately, fundamental analysis yields similar results. Regardless of the metric — price-to-earnings, price-to-sales, price-to-book, market-cap-to-GDP, Q Ratio — the level of speculation in today’s stock market is off the charts.

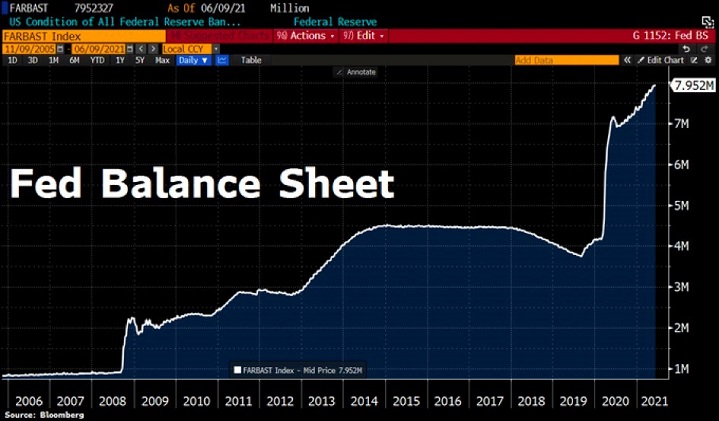

Perhaps it is different this time. After all, the Federal Reserve has never created so many digital dollars before, acquiring so many different asset types and filling the financial system with seemingly endless liquidity. (For that matter, they’ve never manipulated borrowing costs so low for so long.)

Naturally, then, the question becomes, can they really keep it up indefinitely? The Fed balance sheet is surpassing $8 trillion.

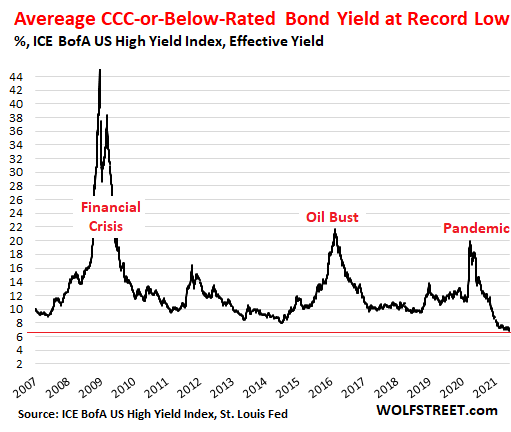

Even if the Fed can keep the digital printing party going, speculative fatigue could set in. For instance, yield-starved investors may question the rationality of giving near-bankrupt entities a big hunk of principal in the hopes of receiving 6% annually.

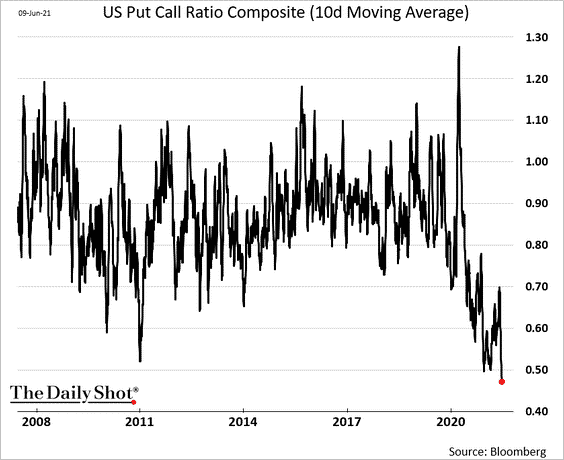

In a similar vein, complacency often meets its own reckoning. Rare are the circumstances when so few investors seek protection from a stock selloff.

Even though Michael Burry believes that entire asset classes (e.g., stocks, bonds, real estate, etc.) are irrationally priced, he is not shorting every security. He is shorting Treasury bonds. He is shorting Tesla.

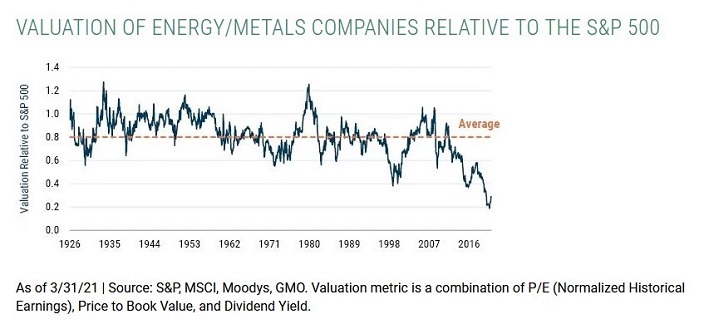

On the flip side, there are pockets of “value” that Burry may be considering. For example, metals/mining and energy are remarkably attractive on a relative basis.

One thing is for certain. Today’s stock bubble is not prepared to be disappointed. Not by the Fed. Not by inflation. And not by the economy itself.

Would you like to receive our weekly newsletter on the stock bubble? Click here.