Households as well as businesses feel wealthier when their stocks, bonds and real estate are gaining in value. It’s called the wealth effect.

The problem with wealth effects? They often reverse course and, eventually, cause market participants to curb participation.

Consider residential real estate. Sales have been plunging throughout 2022 due to substantially higher interest rates.

Not surprisingly, median home prices are starting to “catch down” to diminishing sales. For the first time this year, prices have started to descend from the record peak.

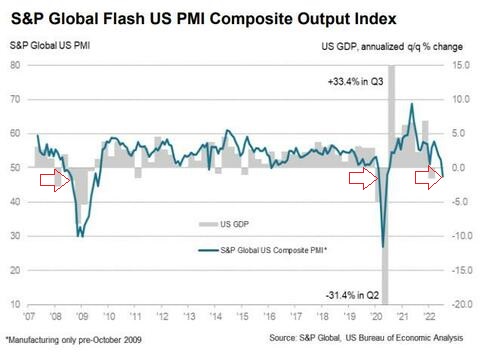

The real estate segment is hardly the only area where economic activity is waning. Manufacturing data shows that recessionary pressure has already infiltrated domestic producers.

Stock market enthusiasts who believe that a recession is avoidable, or that any economic contraction will be mild, may be kidding themselves.

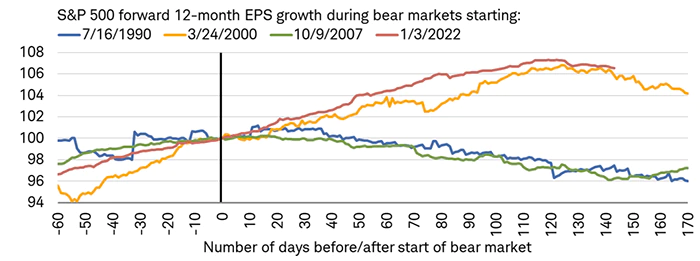

In the dot-com disaster of 2000 and concomitant 2001 recession, the tech heavy Nasdaq fell roughly 75% from peak-to-2002-trough; the S&P 500 gave up approximately 50% in the same period. And the damage played out over multiple years.

It may be worth noting, then, that the current trajectory of the 2022 stock bear has been emulating the path of the bubble bursting from 2000. At least in terms of downward revisions to earnings. What that means is the “E” in P/E ratios will continue to wreak havoc on stock valuations, particularly during the Fed’s rate hiking campaign.

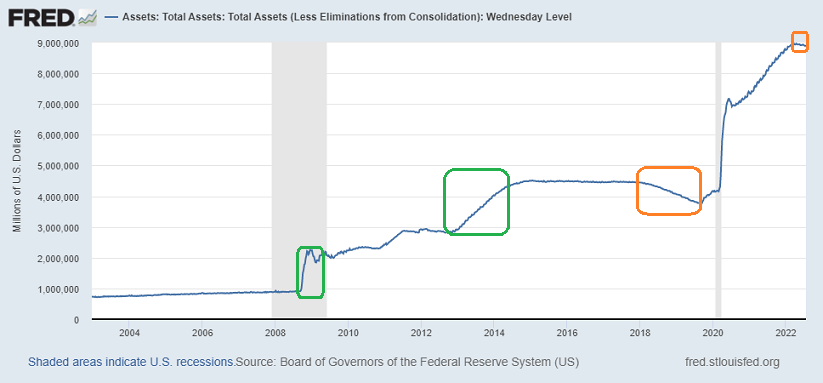

Equally troubling in 2022, the Fed is on a bender to break the back of inflation by manipulating borrowing costs higher. That involves quantitative tightening (QT) where the central bank is shedding assets from its balance sheet.

When the Fed electronically prints money out of the ether to add assets to its balance sheet, a process known as quantitative easing (QE), stocks celebrate. The gains in 2009 and 2013 were 27% and 33% respectively.

In contrast, when the Federal Reserve tried to reduce its money printing footprint in 2018, stocks cratered 20% in November-December of that year. The end-of-year losses of 4% were kept under wraps because “Fed heads” went bank to digital money creation in 2019… and 2020, and 2021.

Is it any surprise that the downward trajectory of Fed’s total assets here in 2022 is already frightening stock investors? Indeed, stocks will have a tough time gaining ground when borrowing costs are higher and consumers/businesses have a more difficult time accessing money.

Would you like to receive our weekly newsletter on the stock bubble? Click here.