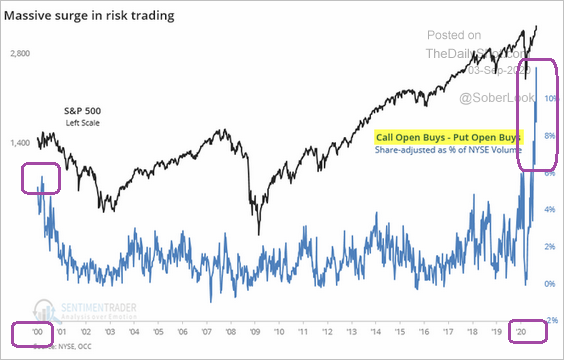

Even in 2000, investors did not fall in love with far out-of-the-money calls on tech shares to juice gains. In 2020? The indefatigable upsurge in call options relative to put protection has been unrivaled.

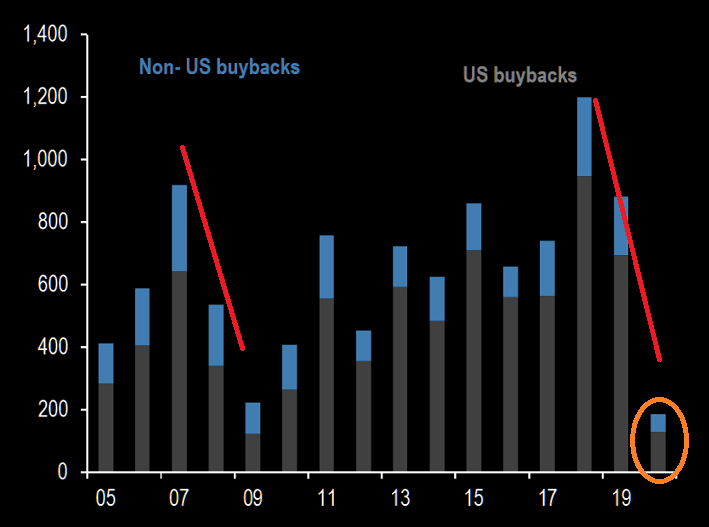

Naturally, this is the sort of nonsensical bullishness that leads to heartbreak. Participants who are taking extraordinary get-rich risks might want to consider the fact the corporations have not been on their team. Stock buybacks, once a bull market support indicator, have been nosediving in 2020.

Granted, we are only talking about corrective activity here in September. And not the second stock bear of 2020.

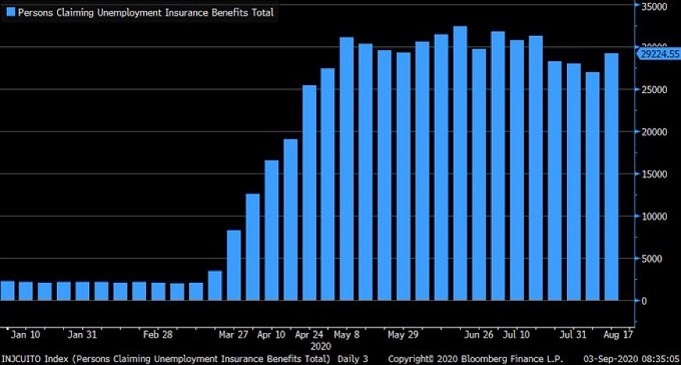

On the flip side, nearly 30 million people still claim some sort of unemployment assistance. It’s difficult to justify the idea that the economy is on its way toward recovering pre-pandemic success.

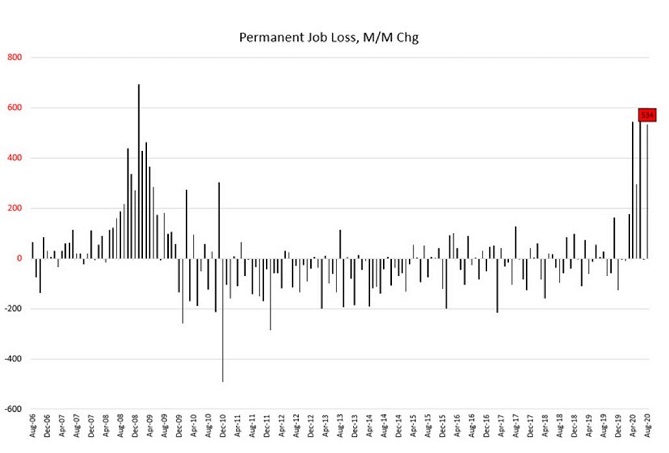

Those who believe that the job losses are merely temporary are not paying attention. In fact, many of those ‘temporary’ furloughs and layoffs are becoming permanent, as can be verified in the month-over-month data.

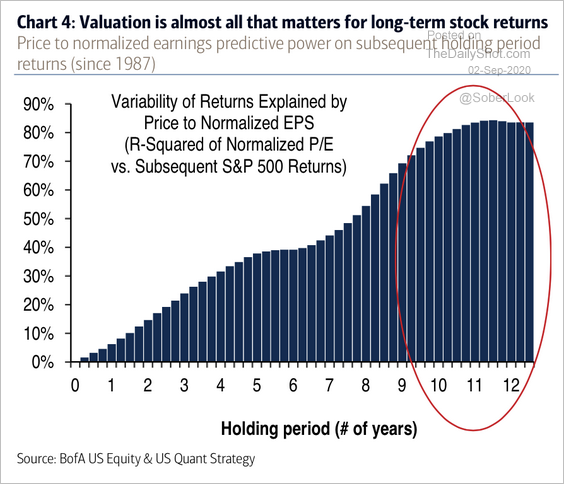

Of course, the biggest issue is the silliness of overpaying for absolutely anything on the belief that the Federal Reserve can backstop assets from deflating sharply. The notion that valuation has any relevance to stock performance may have lost its near-term relevance. However, price-to-earnings ratios still have predictive power across longer periods of time.

With predictive power in mind, what does the following chart say about future return prospects?

Would you like to receive our weekly newsletter on the stock bubble? Click here.