The S&P 500 crossed back above the 3000 marker, despite extraordinary stock overvaluation and economic malaise. It is almost as if investors have decided that the hope for a vaccine can override the credit cycle’s downturn.

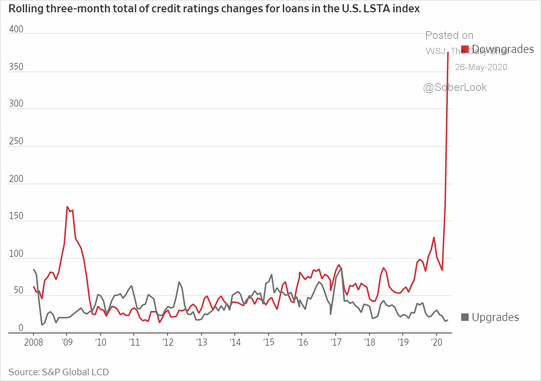

For example, when ratings agencies downgrade the debt of corporations, borrowing costs go up. Some companies will be able to service the higher interest payments, but their future earnings will suffer. The ones the cannot service debt obligations? They will seek bankruptcy protection, completely wiping out stockholders.

Why, then, does the stock bubble behave as if the tsunami of debt downgrades is irrelevant?

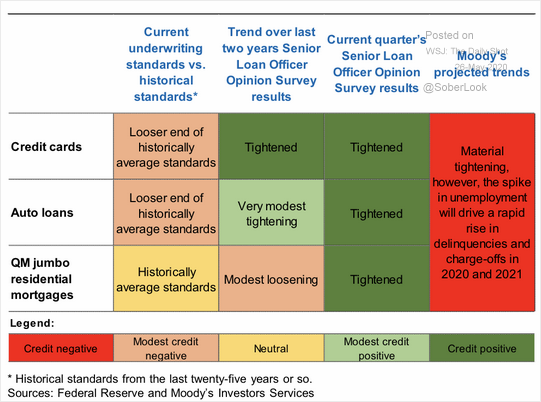

Similarly, in a recessionary environment, lenders restrict household borrowing. From credit cards to HELOCs to auto loans to residential mortgages — financial firms are not showing consumers the money.

If households are unable to obtain the credit they require to consume, how can companies generate enough revenue to service debts or pay dividends? Without robust consumption, how can companies show profits that justify the price of respective stock shares?

Would you like to receive our weekly newsletter on the stock bubble? Click here.