Many describe the U.S. as a consumer-oriented economy. That is because consumer spending, not manufacturing, accounts for two-thirds to three-fourths of economic growth.

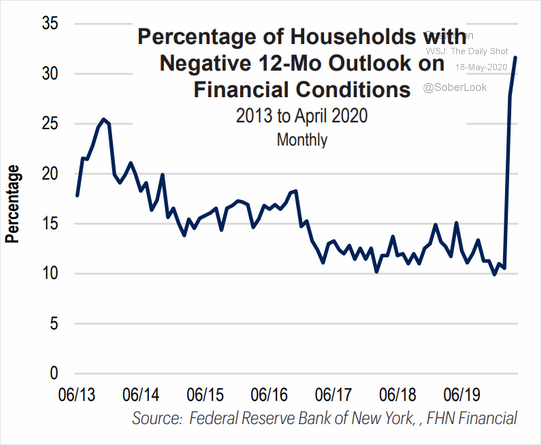

It follows that consumers need to spend for the economy to do well. Yet, at the moment, one-third of households have negative 12-month expectations for their financial conditions.

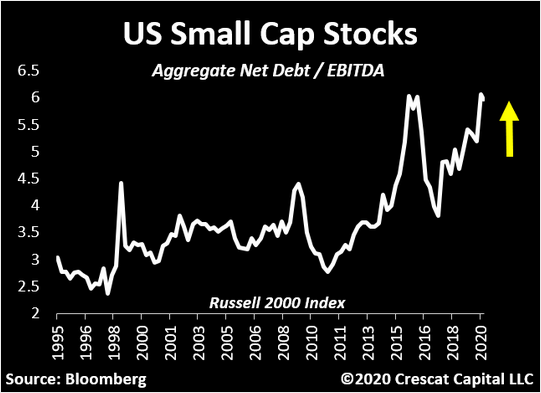

In a similar vein, small businesses have saddled themselves with too much debt. That makes it extremely difficult for these businesses to buy products and services in the future. Companies may need to tighten the spending reins until dwindling revenue can go toward something other than debt servicing and “keep-the-lights-on” expenses.

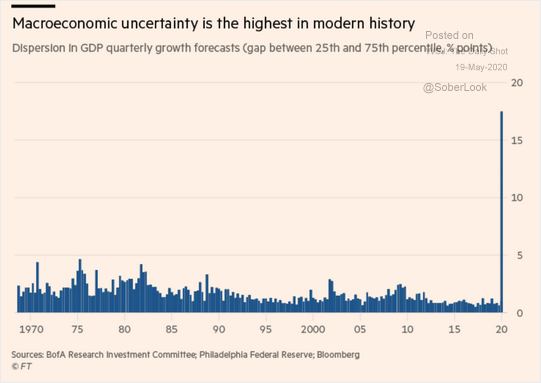

Making matters worse, there is virtually no visibility on economic growth going forward. That uncertainty also extends to the corporate earnings picture 12 months from now.

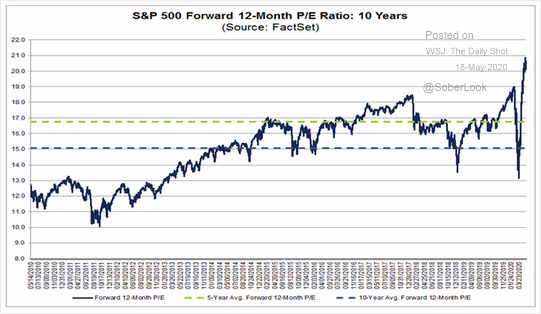

Historically speaking, when the earnings picture is decidedly murky, investors tend to pay a lower price for earnings 12 months out. The average Forward P/E during periods of heightened uncertainty is 13.6.

With the S&P 500 at 2922, and non-GAAP earnings per share at $139.13, the Forward P/E is now at 21. To get to the average Forward P/E, the S&P 500 would need to fall 35.2% to 1892.

The financial media have resorted to explaining why today’s earnings do not matter and why earnings 12 months from now do not matter. The stock market is looking forward to 2022.

If mainstream pundits were more truthful, they’d explain that fundamentals have not mattered for a very long time. What does matter? Federal Reserve intervention.

The Fed is buying Treasuries. They’re buying mortgage-backed bonds and munis. They’re even buying quality corporate bonds as well as junk bond ETFs. The near-limitless liquidity indirectly props up equity prices, regardless of price.

The health of the economy and the fair value of public corporations has become irrelevant. For now.

What could pop the Fed’s stock bubble? An insolvency wave.

In particular, the economy’s recovery will be far slower and much weaker than many envision. Corporate restructurings as well as defaults will render the Fed’s indirect support for stocks insufficient. Then the stock market will move sharply lower.

That said, the Fed won’t give up so easily. They’ll bail out stocks as best they can with direct support. Like Japan, the Fed (and the Treasury) will find a way to buy hundreds of billions of dollars in stock ETFs.

Would you like to receive our weekly newsletter on the stock bubble? Click here.