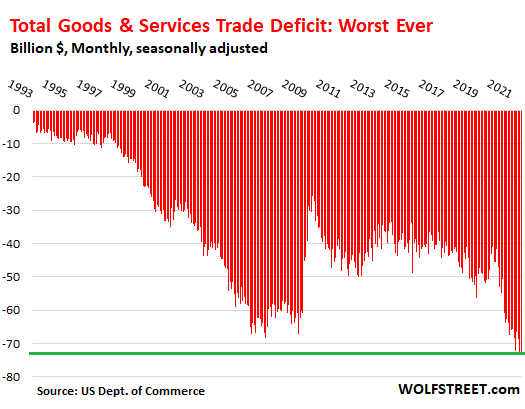

Remember the trade war a few years back? The whole goal had been to shrink our trade deficit with China in an effort to enhance the U.S. economy’s prospects.

Perhaps unfortunately, the U.S. government responded to the coronavirus crisis with far too much stimulus. On the fiscal side, we handed out $5 trillion to the “people.” On the monetary side, the Federal Reserve printed $4.5 trillion for investors to gorge on a seemingly endless supply of money.

The result? Consumer demand overwhelmed supply chains across the globe, while the country’s exports barely kicked up a notch. Now our trade deficit is worse than ever before.

The fact that the U.S. imports so much more than it exports may not mean that our country is in dire straits. It does imply, however, that our endless dependence on foreign production hinders an ability to be self-reliant. Without self-reliance, we are practically begging for supply chain woes and/or longer-lasting inflation.

Indeed, inflation has been hanging around for longer than most “experts” anticipated. What that means is that the Federal Reserve is going to slow the printing of money to acquire bonds.

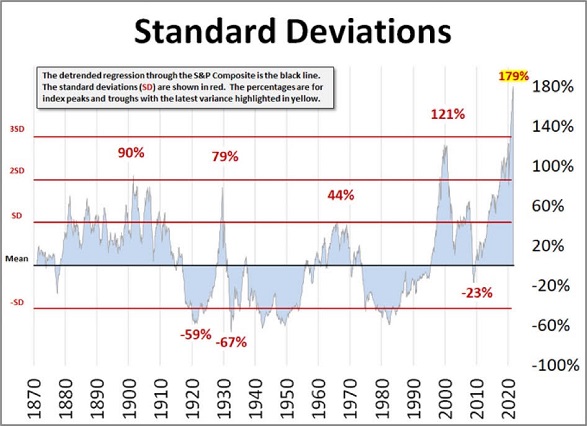

The reality of contracting liquidity and the prospect of higher bond yields is spooking stock market investors. It should. Stock valuations have never been more elevated.

It has been said that, eventually, every statistic will revert back to its average. There are average price-to-earnings ratios; there are average price-to-sales ratios; there are mean or median annual performance for stocks going back to the 1870s.

Regarding the latter, the price of the S&P Composite reached a seemingly insane 121% above trend in 2000. It practically represented a “three-sigma” period that occurs less than 1% of the time.

Today? The stock market is 179% above its trend. And there’s not a reliable metric on earth that does not place stocks as being more overvalued in 2021 than an any other point in recorded history.

By itself, of course, hyper-valuation cannot tell you what the market is going to do next. On the flip side, when you combine headwinds such as inflation, overvaluation, Fed tightening bias, and questionable economic prospects, stocks may potentially become less attractive than alternatives. And that includes zero-percent cash with negative inflation-adjusted returns.

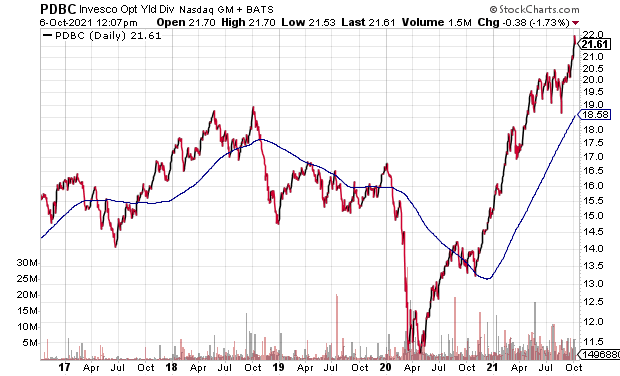

The technical picture is equally concerning. Since the drawdown that occurred due to the pandemic in the first quarter of 2020, the stock market had managed to remain above its 100-day moving average. That triumphant circumstance has since broken down.

In many ways, the issue(s) are relatively straightforward. If commodities are going to pressure inflation by rising like this:

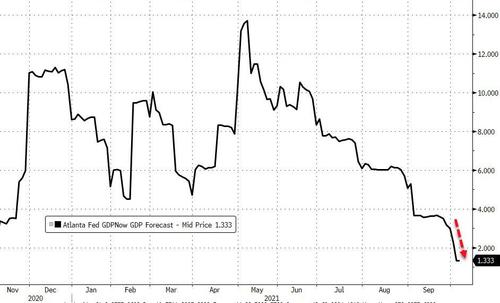

And the economy is going to weaken like this:

And the Fed is going to “taper” or “slow down” its electronic money creation in a manner that pushes U.S. Treasury bond prices lower, then interest rates will climb. Rising yields across many bond types (e.g., mortgage, corporate, municipalities, etc.) raise the cost of borrowing and make it even tougher to justify outlandish stock pricing.

What you’re talking about is the potential for the housing market, muni market and stock market to simultaneously get whacked. Sure the central bank (a.k.a. “Mr. Fed”) can reverse course. Then again, the cross-asset unwind may become so entrenched that more investors want out than want back in.

Would you like to receive our weekly newsletter on the stock bubble? Click here.